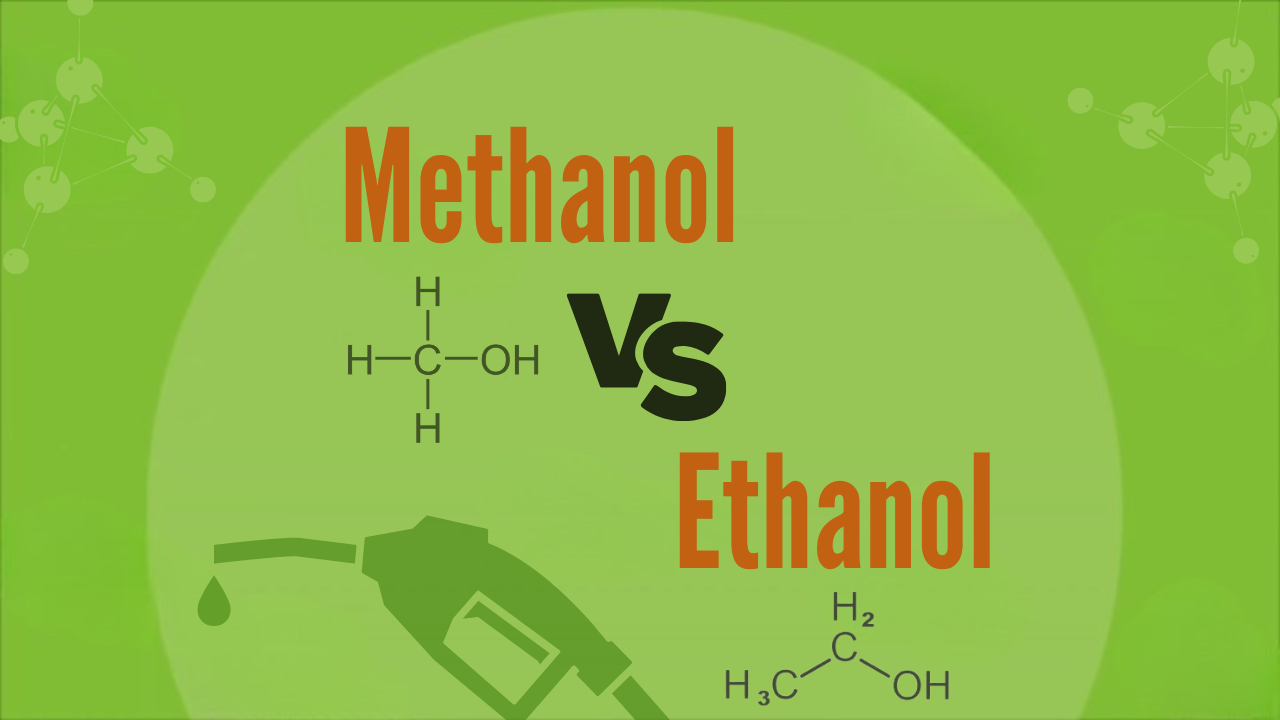

Methanol VS Ethanol – Technical Merits and Political Favoritism

The previous essay sparked a lively discussion about the potential of methanol as a fuel, so I decided to write an essay particularly devoted to methanol. I was especially motivated to write this because of hypocrites who profess to be all about renewable energy and weaning the U.S. off of foreign oil – which explains their … Read more